Although it has faded somewhat from the press in recent months, Israel remains one of the major hubs of the Bitcoin community worldwide. The country may only have a population of 8 million, but its technological and financial center, Tel Aviv, is home to three Bitcoin-accepting restaurants and a rapidly growing number of startups, and is arguably the birthplace of a Bitcoin technology that has seen a considerable amount of attention in the past few weeks: colored coins. The theoretical background behind the idea was developed with the help of Meni Rosenfeld, an Israeli mathematician who has also been a main organizer of the Israeli Bitcoin community for the last two and a half years. The furthest developed implementation of the project today, Webcoinx, was written mostly by Ukrainian developer Alex Mizrahi, but was funded by eToro, a popular “social investing” network whose main offices are also located in Tel Aviv.

Israel first publicly burst onto the Bitcoin scene in January 2013, when Ron Gross, another organizer of the local Bitcoin meetup group, made a post on the Bitcointalk forums entitled “Bitcoin is booming in Israel”. Gross wrote:

There’s been a nice Israeli group of Bitcoiners for some time, growing over the last ~ 1.5 years. So far our Meetup has reached about 100 people, with about 15-20 active members. Then, on last Thursday, something happened. Bitcoin was covered on the front page of a major “popular economics” paper, and then later that day a major TV channel (Channel 10) did a late-night 7 minute story about Bitcoin (featuring, among others, Meir Shitrit, a former minister of finance). Suddenly, we’ve had a boom in Bitcoin interest. Our meetup now contains 145 people (40% increase in 3 days!). Our local forum bitcoin.org.il has seen an influx of new users, as well as our Facebook page. People want to invest, learn, evangelize … it’s quite awesome!

Two weeks later, Gross posted that the latest Israeli Bitcoin meetup had over a hundred people attending – nearly ten times the amount that it had only two months previously. But the Israeli Bitcoin community’s luck did not stop there. Two months after that, the Israeli Bitcoin meetup in March had over 160 people, and although attention has reduced somewhat since the peak the Israeli Bitcoin community remains one of the most cohesive, and one of the most entrepreneurial, out there; the Israeli Bitcoin community is responsible for colored coins, the instant altcoin exchange Coinpair, the peer-to-peer Bitspend alternative Proxycoins, and many others. Now, the latest development in Israel is the emergence of the Israeli Bitcoin Association, a national Bitcoin group similar in spirit to the Bitcoin Alliance of Canada.

In this multipart interview, Meni Rosenfeld and Ron Gross will talk about developments in the Israeli Bitcoin community, their own efforts in organizing community events and meetups, their other Bitcoin-related projects and the vision that they have for the Israeli Bitcoin Association.

Vitalik Buterin: First of all, could you introduce yourselves? Who were you before Bitcoin came along, and how did you first get into Bitcoin?

Meni Rosenfeld: I’m a mathematician, I studied a master’s degree in mathematics, and then I worked for about 2 years for a company called SimilarGroup, which is a startup developing solutions for finding websites and measuring web traffic. I worked there as the head of algorithms research, and then I learned about Bitcoin from a blog post on lesswrong.com, which is a blog about rationality, and they mentioned that the Singularity Institute [now the Machine Intelligence Research Insitute] started accepting Bitcoin donations, so that’s how I first learned about it, and then of course I started looking into what it is exactly. Even while I was still employed full-time I spent a lot of time reading about Bitcoin, participating in the forums, and so on.

Then I started two projects. First I did some search about mining pool reward methods, so in March 2011 I developed the geometric method, which is the first non-pay-per-share hopping-proof method, and I moved on to develop BGM, which is better, and I wrote an analysis of Bitcoin mining pool reward methods. The other part is that I wanted to develop the situation of Bitcoin in Israel, so in April I started Bitcoil, which was Israel’s first Bitcoin exchange service, and by August of 2011 I realized that Bitcoin has a lot of potential and my business has a lot of potential, so I started to phase out my earlier job at Similar Group. I moved on to a 20% position and focused all my time on Bitcoin-related things, including research, my exchange business, and activity in the community.

Then, in the beginning of 2013, Bitcoin picked up all over the world, but especially in Israel, so I had a lot more work in the exchange business and in the community. January 2013 was also about the time that Ron joined me as a partner at Bitcoil, and of course before then were together on building the community, organizing meetups and so on. But that’s also when the problems with the banks began to manifest, so after a few months my exchange service wasn’t working anymore, so that became a slow process, but eventually I put that on the backburner. I focused some of my time on doing consultation work to a few companies, right now most notably BitsOfGold and Bitblu, and I spent also a lot of time on activities involving the community in Israel. We recently started establishing the Israeli Bitcoin Association, so we are going to direct a lot of effort into that.

Ron Gross: I’m a software engineer and system architect by profession. I’m a graduate of the Technion university [in Haifa, Israel], and I worked at a few startups, and at Google for half a year, where I learned I don’t want to work at a large company. when I found Bitcoin I was between jobs. In March 2011 I saw a posting on Slashdot of Mike Hearn and BitcoinJ. I saw it was someone from Google, so I was interested; that gave it immediate credibility, and I dug in and saw all the information out there. I immediately understood the big revolution that was going on, I started reading about it and writing on the forums and on my blog, telling everyone I know that they should buy some. Meni and I found each other through Bitcointalk at first-

MR: Actually, I think the first time I heard about Ron, I didn’t know his name was Ron at the time, was because his father was the second customer of my Bitcoin business, and he told me that he has a son who is into technology, so naturally we got together.

RG: So yeah, Meni and I started doing meetups here. The first meetup was Meni, myself and some other person, who left about ten minutes afterwards.

MR: No, he stayed for half an hour to an hour.

RG: Okay. And the first meetup was three people, the next was ten people, and we saw that these meetups kept attracting more and more people, more diverse people, more influential people, all sorts of people really. In these two years Bitcoin has consumed a lot of my time, and at the beginning of 2013 I finally made a decision to do something beyond the community work and giving presentations – I decided to join Meni as a partner to Bitcoil, which was the only Israeli exchange at the time as it was before the big explosion of popularity. I wanted to make sure Israelis have an easy way to access Bitcoin and get into the economy and out of the economy as they wish. A few weeks after we made our agreement, the volume started increasing rapidly, as did the attention by customers and by the banks, and as Meni said we couldn’t find a way to continue operating an exchange in Israel, and after a few months of that I decided that this kind of business was maybe not the right kind of business for me, as we’re too much at the mercy of the banks, and I started looking for other opportunities in the space.

I’ve been following alternative cryptocurrencies for a long time, ever since the first few currencies came up, and I diversified my own portfolio to these currencies whenever I saw an interesting one. There are tons of new currencies; most of them are junk, but a few of them are really innovative. So I have been doing this diversification on my own and I believe that for everyone in Bitcoin today it is better as an investment route to diversify some of their portfolio to these currencies, and so I decided to build a product that simplifies this for the people. And recently a few months ago I started lowering the time I spend in my day job more and more, and maybe one or two months ago I quit, so now I’m fully dedicated to founding Bitblu along with my partner Yuval Bergman, and as Meni said, both of us and a few other people have been founding the Israeli Bitcoin Association and trying to establish a dialogue with the regulators and the banks. One last thing about myself is that I’m also deeply involved with the Mastercoin project; I’m in the board of directors, and I’ve been following the project and supporting it for sometime.

Building Community

VB: Can we talk more about the meetups?

MR: The first one was in August 2011, right after the first conference in New York. It was three people, and then we had one every two months. Until maybe October 2012, it was ten to twenty people each time, and in 2013 it started getting bigger. In January, there were about 120 people, and in March it was 160 people. But then because there were so many people it also took a lot of effort to organize it properly, and we didn’t have so much time because we were occupied with other things, so there was a big pause in the meetups. Finally we figured out that the best thing is to reduce their scope so there are more meetups with smaller capacities. In March we had four lectures and two mini-lectures so there was a lot to do. But now, in each meetup we have one lecture, and we are not setting up too many expectations; we are just saying that there will be a lecture at this time.

We do it now in the offices of Google; they have a whole floor that is dedicated to having people come and give lectures. Google also gives some refreshments, which is nice, and it’s pretty easy to organize. Before that there was also an issue with trying to find the right place for the meetup each time, but now we don’t worry about it. We just go to Google and that’s it, so we can do such a thing every two weeks. Every time we find a lecturer and a topic, and to these meetups between forty and eighty people come, so given the fact that it’s much more frequent it’s still a big group, and in the future in a few months we will a organize a conference here in Israel for the local community, and some time after that we hope to host a global Bitcoin conference in Israel.

VB: What kinds of topics are the lectures usually on?

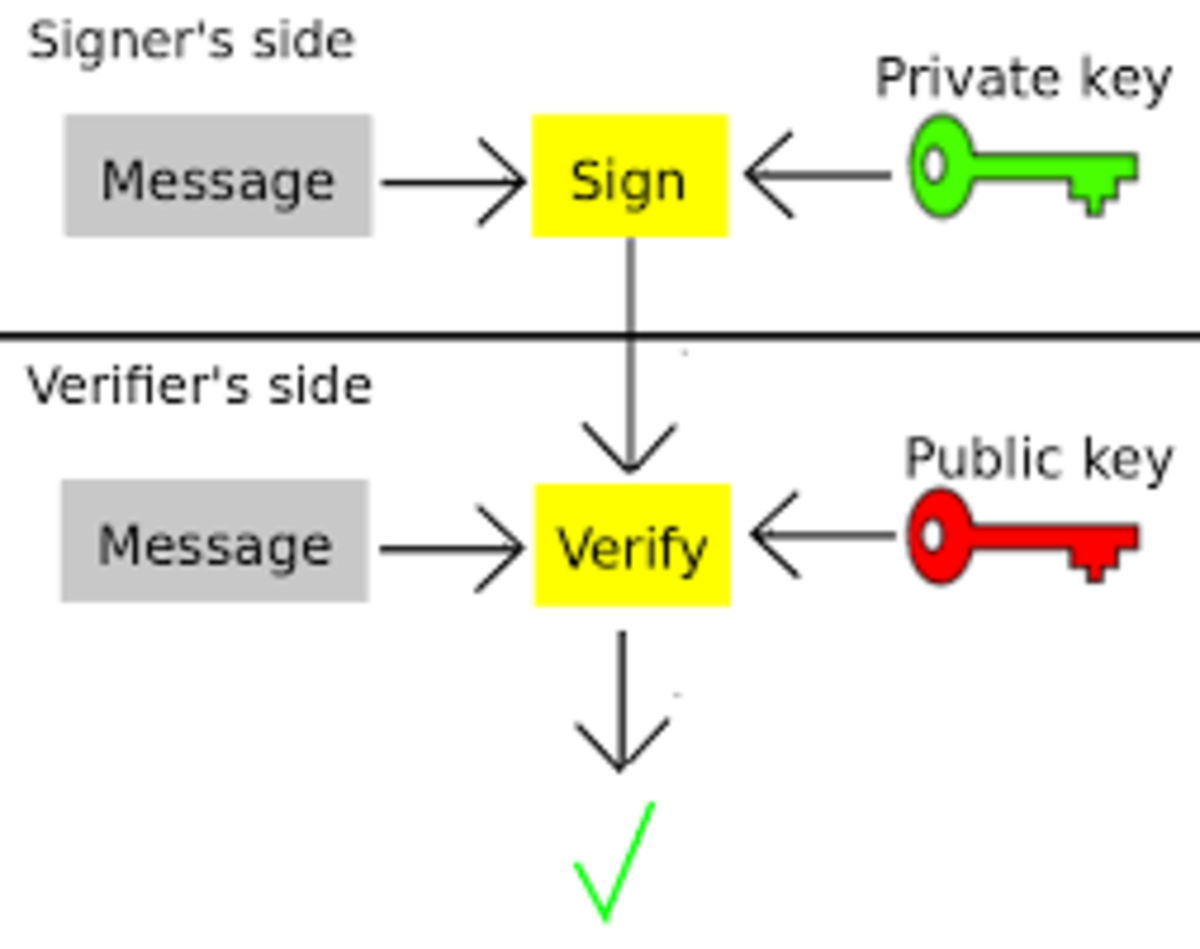

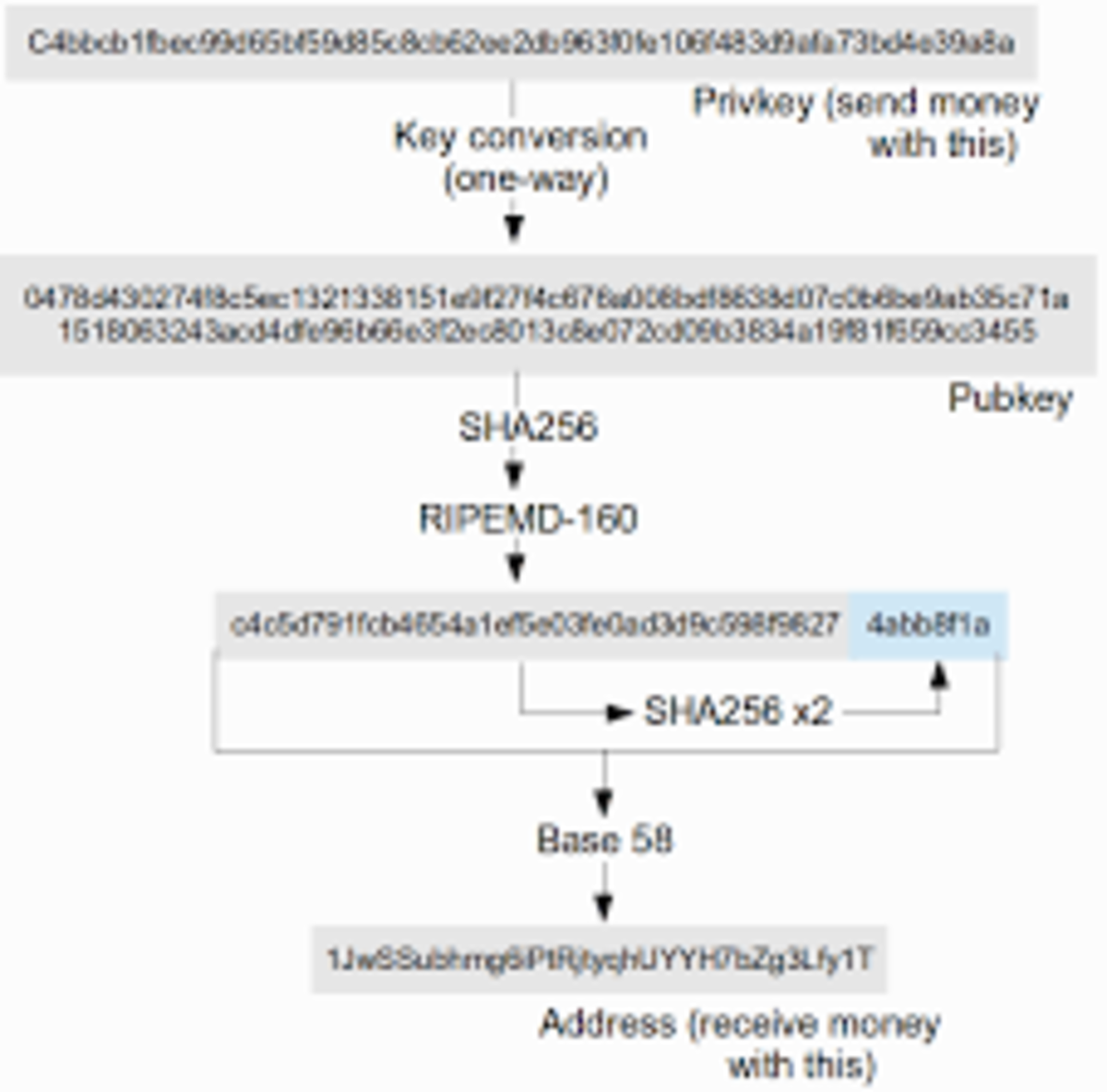

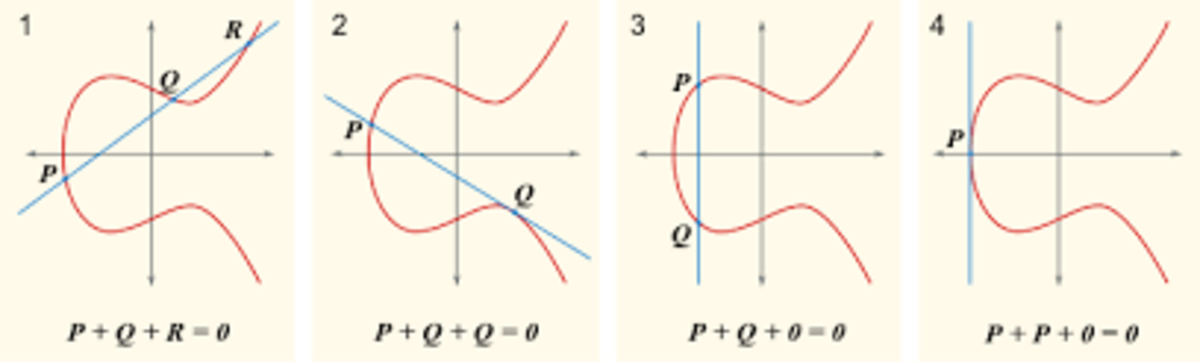

RG: We have several. We have all kinds of levels of difficulty and familiarity with Bitcoin; the latest one was an introduction to security. Half was basic computer security, and a little bit was about Bitcoin, how to use a wallet and stuff like that. Our technical lecture is going to be about how the blockchain works, that’s the next one, we’re also planning a lecture of about borderless society and what the society will look like when everyone uses Bitcoin.

VB: Are there many connections between Bitcoin and the local math and cryptography community?

MR: Of the ties that are now between Bitcoin and the local academia, the most well-known is Adi Shamir, he is the S of RSA), a famous cryptographer who has been interested in Bitcoin for a while, and recently he and Dorit Ron wrote a paper analyzing the Bitcoin transaction graph. In addition we have Eli ben Sasson, who is a professor from the Technion, and he has done some very interesting research about secure computational integrity and privacy, and he also has some very interesting ideas about how to apply this to Bitcoin. In addition we have Aviv Zohar, who is working with Microsoft Research, and he and a few others wrote a paper a year or two ago called “Bitcoin and Red Balloons“, where they propose a system to incentivize nodes to propagate transactions, and so they have a system where each node that propagates a transaction gets a cut of the transaction fees collected.

VB: What are the biggest reasons why people here are interested in Bitcoin?

RG: There are many really, it’s hard to say which is bigger. I think that maybe the easiest to understand is financial incentive. They hear about it, they see a price chart, they extrapolate, they know where it’s going to be in ten years (or they think they know). Of course, there are those that do the long-term investing, and there are those that buy and sell to make a short-term profit,but in general the financial incentive is there. It’s an interesting market to play at. There are of course the mathematicians and the researchers that come for the complexity of the protocol; there are people interested an an alternative to banks; they know that the current financial system is not stable, and people read about things happening in the United States, in Cyprus, and all around the world, and they’re afraid to keep their money in the banks to some degree.

MR: Israel is known as a very entrepreneurial country, so people are interested in innovations and trying new things. So once they get past the initial barrier of skepticism about Bitcoin, they are very receptive to this innovation. There are also some other quirks about the Israeli mentality which may make them more receptive to Bitcoin. For example, Israelis really don’t want to be suckers or for people to screw them over, so if they feel that they are suckers because of the way the financial industry and the banks treat them, then they will want an alternative.

RG: I would rephrase that as: Israelis don’t like being told what to do. And with Bitcoin you don’t have to ask anyone to do what you want to do, so it’s very appealing.

Bitcoin Business

Vitalik Buterin: What about Bitcoin businesses in Israel?

Ron Gross: I think the first wave was just exchanges. Bitcoil was the first Bitcoin company in Israel, and in the past two or three months we had ten exchanges in Israel. Of course, most of them didn’t work out, but this was the first wave.

Meni Rosenfeld: The first one, Bitcoil, appeared in April 2011 and the next one was about 1.5 years later in October 2012. There was something called Bitcoin Israel, which is run by a mysterious guy in Jerusalem who doesn’t interact much with the community but is doing some good work, and then in 2013 things started to pick up and there were many more. So now we have BitsOfGold and BitGo, the somewhat smaller Bitcoinexchange, and many other wannabes. There is also a local market exchange, Bit2c.

RG>: So this was maybe the first wave of companies. There are a few other businesses. I think there are companies in Israel that are trying to build ASICs. There is my startup, Bitblu; we’re doing diversification into altcoins and mining bonds in one platform. There is a startup that is not really a Bitcoin startup per se, called AppCoin, run by a big Bitcoin fanatic who went to the early Bitcoin meetups when he had time. In his words, Bitcoin is the answer for decentralized currencies, AppCoin is the answer for centralized currencies. They argue that there are still use cases where it’s better to have centralized currency – community coins, local coins, and the like, and they currently have a trial with a few of these community coins, and they’re building a platform for people to set up these coins very easily. There is also CoinPair, Proxycoins.

MR: Maybe we can take a bit of credit for Lamassu. Of course, they are in New Hampshire now, but originally they were from here. Other than that, there is Buy the Way.

RG: Buy the Way is trying to create a sort of social wallet for Bitcoin. Right now there isn’t really a good wallet for Bitcoin. Each wallet has its own limitations and difficulties. They are trying to create a wallet that is easy to use in social contexts – either a friend shopping for another friend or other similar use cases.

MR: there is another thing which isn’t exactly a startup, but it is a Bitcoin initiative which has a lot of support in Israel, which is colored coins. So many of the people who first started to work on it were in Israel, and it gets a lot of support from an Israeli company called eToro, which also itself has some involvement with Bitcoin. It’s a large social investment network, run by Yoni Assia who is a big Bitcoin enthusiast, so they are pushing Bitcoin in general and specifically colored coins, so right now the main developer is Alex Mizrahi from Ukraine, but they also do a lot of support and promotional work, there are some nice promotional videos that they put up, and there is a website, coloredcoins.org, for information.

RG: One more thing that I want to specify is that one of the founding members of the Bitcoin Association is Eden Shochat, who is a senior VC partner who just founded a new VC fund, called Aleph, and while Aleph has not explicitly said that they are or are not looking for Bitcoin investments, Eden is really interested in the subject and is contributing his time and connections to help us.

VB: Is the Israeli Bitcoin community mostly in Tel Aviv or elsewhere as well?

MR: There are people involved in Bitcoin all over the country. Right now, most of the activity happens in Tel Aviv because it’s a big city and it’s pretty central, and most people can get to Tel Aviv. But there are people all over the country, most notably Haifa and Jerusalem, so we also want to do a meetup in Haifa and a meetup in Jerusalem, so people in the north and people in Jerusalem can also come. There are a few Bitcoin users in Jerusalem, and they come to Tel Aviv, but we want to do something exclusive to them.

RG: I’m originally from the Haifa area, and I’ve been wanting to do a Bitcoin meetup there for a year and a half. I spoke there once at a gathering, they invited me to speak there, but it wasn’t a proper Bitcoin meetup. I just haven’t had time.

MR: I’m also originally from Haifa.

VB: What about Bitcoin restaurants?

MR: There are two bars; there is one place that was the first Bitcoin business to accept Bitcoin in Israel, called the Bar Kayma, which is a bar and vegan restaurant. They are also not an ordinary business, but a cooperative owned collectively by each member. There is another bar, October Bar, nearby, and Galabi – Anat’s Place, a restaurant.

RG: And recently just last week I visited a chain of vegan restaurants called Buddha Burgers and I was just asking the owners if they know about Bitcoin. They replied that, yes, they know about it, and lots of people have asked them to accept it. They want to do it; they just need to prioritize among all the different activities that they have, but it’s on their roadmap.

MR: Another interesting thing, there is a chain of food delivery places and they are working on integrating Bitcoin payments. Some of the details are still confidential, but they have a few hundred merchants working with them, so when they decide to launch it will be significant.

VB: To wrap up, what do you see in the near future of the Israeli Bitcoin community?

MR: So far the plan is to get the Israeli Bitcoin Association much more established formally. Right now we have been working on how to define the structure and the way accounting is done, so we want to finish that. Then we can continue to work on our two main agendas. One is the main dialogue with the authorities and the banks to try to find a solution so that the people in Israel who want to do something about Bitcoin, whether they want to buy bitcoins or make a startup, will be able to do that. The other thing is to continue with the education initiatives, have more meetups, lectures, conferences and so on, improve our community further with information and new users, and we are also planning on some other outreach initiatives such as radio ads, promoting Bitcoin as so on, so it will be a lot of work getting people to know about it and do something with it.

In the next part of this interview, we will talk about the upcoming pinnacle of Israeli Bitcoin community organization, the Israeli Bitcoin Association.